NOTE: Cost quoted come from centered on a good 680 credit rating and you can is susceptible to changes

Last times We composed regarding guidance I have been seeing appearing within my Facebook offer out-of Dave Ramsey for the mortgages. There are some things that I simply cannot pick practical to possess the patient who wants to buy a home, like only using good fifteen 12 months amortized home loan having 20% advance payment and you can restricting the mortgage payment so you’re able to twenty-five% of take-home spend. We guaranteed that we create display a follow-up blog post where We comment more circumstances comparing their recommend to help you real world problems.

I thought i’d get back many years and you can base this writeup on certain customers just who We aided buy their very first household into 2019. One partner keeps constant employment in which he’s paid a salary several overtime together with almost every other keeps earnings which is hourly and has perhaps not come on the jobs for long. At the time, the audience is simply able make use of the salaried earnings out of $5700 a month. He’s up to $5,000 in the discounts (excluding a pension account) and $485 four weeks indebted (for their vehicle and you can college loans).

When it couple would be to pursue Dave’s testimonial, they would has a very difficult time-saving upwards to have good 20% down-payment, let-alone waiting to do that up until they are also financial obligation free. Obviously this would most readily useful…but while they’re seeking to pay-off debt and you may conserve a life threatening amount of cash, construction costs are trending higher.

According to Dave, so it couple must not has an entire mortgage repayment (in addition to assets taxation and you may property owners insurance policies) greater than twenty five% of their just take-house spend (once taxes and you can insurance coverage). That would mean a complete mortgage payment out of just about $1380. (The get hold of spend just after taxation and insurance policies toward $6700 was basically from the $5520. 5520 x twenty five% = $1380).

NOTE: Costs printed here are regarding as they are expired. Costs alter constantly while the they have been according to bonds (home loan recognized securties). For your personal rate quotation for your house found anywhere in Washington condition, please click the link. Observe a detailed Total price Data looking at the expense of waiting to purchase a property, just click here.

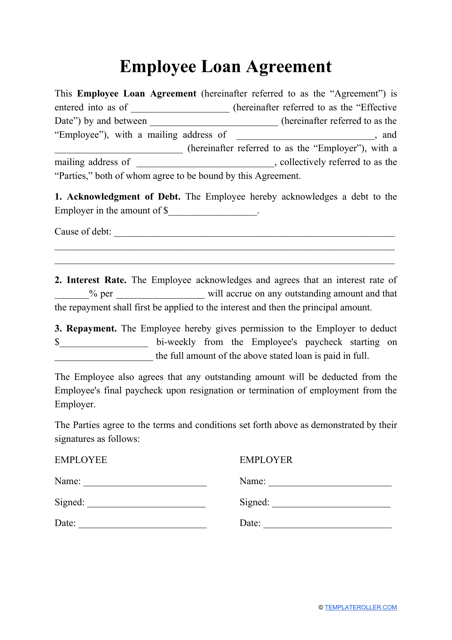

If they adhere DR’s information and you can choose for good 15 seasons antique home loan with a good twenty percent down-payment (2nd column a lot more than), having a mortgage payment just about $1380 (also taxation and you will insurance rates); it be eligible for a home rates around $210,000. That is centered on an interest rate of dos.375% (Annual percentage rate 2.734%) that have write off factors of just one.025%. They might you want doing $50,000 getting funds having closure, in addition to deposit and you can closure rates. Actually back in 2019, might has a challenging time finding a house at that speed to boost children.

Whenever they choose fold DR’s advice a bit and you can do a 30 seasons repaired having 30 seasons conventional home loan having good 20% down payment (3rd column a lot more than) then your conversion price they be eligible for expands so you can $290,000. This can be centered on mortgage loan from step three.125% (, this is still an extremely challenging rate to obtain a home.

For it condition, let’s hypothetically say he’s a couple with a mid-credit rating away from 680

My clients were indeed able to get a property when you look at the Renton valued to own $375,000 inside the 2019 with the Domestic Virtue deposit program we bring from the Arizona County Houses Financing Percentage. Its first mortgage is FHA while the down-payment help is in reality an additional home loan having 0% desire and no payments due that’s tacked to the prevent of one’s first-mortgage (fundamentally it’s paid off if house is refinanced or offered). Brand new FHA 30 season fixed home loan has a speeds of step 3.875% (Annual percentage rate 4.931% comes with upfront and you may month-to-month financial insurance). NOTE: The brand new Annual percentage rate cited about graph more than it circumstance (fourth line) is blending the initial mortgage away from $ and a second mortgage out of $14,728. They only necessary $5700 to have complete loans to possess closure and their full month-to-month financial payment, as well as property taxation, insurance rates and you may mortgage insurance policy is $.

The present day estimated value of the home they purchased in 2019 for $375,000 is actually projected at the $550,000 (fifth column). Whenever they would be to buy it today having fun with a keen FHA mortgage which have the absolute minimum down payment regarding step 3.5%, they’d you prefer up to $33,000 for downpayment and you may closing costs. The complete projected percentage try $3194 considering an interest rate from dos.625% (Annual percentage rate 3.710%) valued that have 0.713% within the discount situations. Until they’ve got acquired introduces otherwise possess paid back specific loans, they e house today into big mortgage repayment.

As an alternative, simply because they available in 2019, it today is actually experiencing the benefits of which have enjoy within house or apartment with this new expanding guarantee. They would not have over $100,000 in home equity now whenever they had been trying to rescue for 20% down-payment. Whenever they wanted, they are able to fool around with some of the security to buy its 2nd family, pay back expense otherwise enhance their home. Once again, the opportunity they will not have when they have been tight supporters from Mr. Ramsey.

I believe it is very important create told decisions regarding the money. Property is North Dakota loans one of the biggest house and bills the majority of people can get inside their lifetimes. For those who have lots of assets, upcoming following the Dave’s guidance could possibly get meet your needs…however if you aren’t because standing, the expense of to shop for a house ount most people can help to save to arrive you to ideal twenty % down payment.

I additionally tend to lean for the 29 12 months repaired home loan across the 15 seasons fixed given that they you may have even more flexibility into the 30 12 months payment. In the event that one thing were to accidentally your wellbeing or employment, the new payment youre arranged and then make is much down with a thirty year. And you may usually shell out a lot more toward dominating that have good 31 season traditional mortgage to invest it well eventually. Truly, I’d use the difference in fee to pay for my personal retirement, pay off expenses and construct my discounts just before expenses more towards the dominating to my financial…but that is merely me personally ??

For your individual rates quotation to own a property discovered anywhere in Arizona condition, excite click on this link. Income tax benefit and you will online payment per month is using a beneficial twelve% tax bracket. Their income tax work for can differ. Please speak to your CPA otherwise taxation professional for more information.