History day Lender consumers obtained notice which they you are going to prefer ranging from several different types of availableness securities. Although this triggered specific frustration, they emphasized that people do not most know how its supply thread work and the ways to increase the benefit.

Many people explore an accessibility bond due to the fact a spot to store additional money: by paying in more versus expected montly fees matter, the attention you pay on your home loan is actually less, however the availableness facility implies that this type of too-much fund come for you to withdraw when needed. Very, instance, certain family use this facility to save doing shell out its yearly college fees because a lump sum payment.

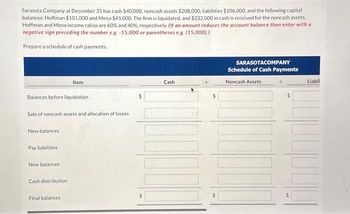

Andrew van der Hoven, head regarding Lenders within Financial institution, says the lending company found that inside scenario, everyone was never sure of how amortisation performs and how much of those additional repayments translated for the a detachment business. Based on how your monthly money is calculated, the additional repayments might not be fully available for withdrawal and your own financial period may possibly not be reduced.

Lower month-to-month instalments

In case where the even more contributions result in a decrease of your month-to-month bond instalment, the phrase of one’s loan continues to be the exact same. While you are not paying off your home loan any fundamentally, you are doing conserve attract, because desire could well be calculated towards a diminished a fantastic balance.

Spending a lowered monthly bond instalment, yet not, means that a fraction of the more share have a tendency to financing brand new financial support a portion of the home loan maybe not protected by the reduced instalment. You will still manage to withdraw available loans nonetheless they will certainly reduce throughout the years because you are taking this benefit inside the less monthly instalment. Instance, for those who made a supplementary percentage off R100 000 to your R1 mil financing inside seasons four (sixty days), just after annually the brand new offered balance you might withdraw will have faster so you can R96 968.

Month-to-month instalments remain an identical

In the event where your own most efforts do not slow down the monthly thread instalment, and therefore continues to be the identical to from the first contract, you are going to pay off the mortgage in the course of time if you do not availableness those people a lot more fund. The total amount in your case to gain access to will grow per month because you will be paying off a lot more investment. In the same circumstances of a beneficial R100 000 deposit inside the season five, shortly after per year, this new available harmony you could potentially withdraw would have increased to R110 471.

Lender has provided for a couple of different varieties of accessibility ties in which a consumer can choose whether or not its purpose would be to pay from the mortgage sooner and cut, or if they want to use the even more sum to attenuate its monthly fees when you find yourself however that have a portion of those most financing given that fund to gain access to.

Standard bank allows customers to alter ranging from this type of options immediately following an excellent few days, but not, van der Hover says that most existing customers have left to have the following choice ? minimizing the instalments ? which is a sign of you to definitely house get much more troubled and want to deal with the month-to-month income.

The two additional payment choices promote a example understand how their availability bond performs. Remember that if for loan places Andalusia example the financial automatically decreases the monthly thread instalment immediately following an additional sum, you are going to need to ideal which right up every month towards unique instalment to pay your loan at some point.

Remaining the financing range discover

The original availableness bond are lead in early 2000s and you can desired a buyers to borrow to their unique borrowing from the bank facility until the termination of the expression.