When mortgage lenders and you will nurses get together, as a result, a collection from personal financial selling you to can also be significantly lighten the monetary load of shopping for property. Nurses can be make use of discounts as a result of programs such as for instance HEROs Homebuyer Applications, that offer a medley of provides, rebates, and you will less costs designed so you’re able to medical care experts. Typically, the new offers can be reach up to $step three,000, an expense that may build a substantial huge difference whenever budgeting getting an alternate family.

- Closing credits

- Elimination of of a lot fees during the closing

- Straight down rates

- Smaller down payments

- Much more flexible qualification criteria one to echo their elite group balances and you will accuracy

This type of procedures aren’t merely incentives; these include a detection of one’s pivotal role nurses play inside our teams. Of the integrating which have individual loan providers, nurses will enjoy these gurus.

Navigating the borrowed funds landscape since the a nursing assistant can be expose novel challenges, but with the best procedures, these hurdles will likely be transformed into stepping-stones. Comprehensive a job documents is vital, as well as dealing with income balances concerns head-for the, particularly for travelling nurses who can experience fluctuating income and you will a job designs. Moreover, handling student loans is crucial, which have apps such as for instance Nursing assistant Corps Mortgage Fees offering to pay right up to 85% of outstanding scholar obligations, and thus to present a far more positive reputation in order to lenders.

Money verification can be nuanced, which have non-nonexempt and each diem spend requiring careful paperwork. Tax returns, spend stubs, dollars reserves, or workplace personal loans for bad credit California emails confirming the probability of went on money is all of the act as evidence of financial balance, bolstering an effective nurse’s mortgage degree candidates. Because of the to provide a very clear and you can total economic photo, and additionally their personal debt in order to earnings ratio, nurses is effectively browse the mortgage process, beating barriers confidently and quality.

Selecting the most appropriate Home loan Road: Helpful tips for Nurses

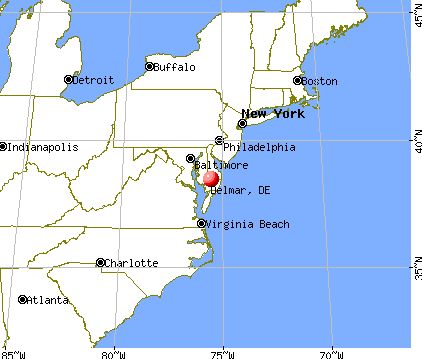

Entering the way in order to homeownership starts with selecting the mortgage that most useful aligns with one’s monetary and personal affairs. To possess nurses, it indicates providing a closer look within fico scores, evaluating down payment prospective, and you will as a result of the located area of the desired property. While you are Va fund may well not explicitly mandate at least credit score, loan providers normally like a score of at least 620, illustrating the significance of creditworthiness regarding choices techniques.

Figuring just how much home one can afford is the carrying out take off, making certain the newest picked financial fits contained in this a constant money records, a requirement shared across the really home loan factors. Nurses is to method it elizabeth care and attention and you may diligence they incorporate for the its industry, consider the factors to see a mortgage that offers just a home, however, a property one to nurtures well-being and you may stability.

Mortgage System Insights to own Medical care Professionals

Medical care workers, together with nurses, find solace and you will help from inside the home loan system solutions designed the help of its book economic need and you will community trajectories at heart. Character Homebuyer Apps streamline this new to acquire process, giving accessible and you will sensible paths so you’re able to homeownership. Furthermore, doctor lenders appeal to those with significant education loan financial obligation and restricted deposit information, providing customized money options you to acknowledge the fresh high money and requiring really works times from medical professionals.

Applications like Home to have Heroes stretch their positive points to new larger healthcare neighborhood, complimentary positives with home and you may financial specialist exactly who understand their unique issues.

For those whose financial dreams outstrip old-fashioned limits, specific physician loan apps offer investment options one soar beyond the $3.5 mil s is actually within reach.

Resource Your house: Tips for Enhancing Approval Chance

Protecting a home loan is a milestone yourself-to find excursion, and you will nurses can enhance the odds of approval because of the targeting high fico scores, which discover better mortgage conditions such as straight down rates and you can off money. Engaging which have a card fix pro can be a strategic disperse, as it can bring about enhanced credit scores you to pave this new answer to favorable mortgage standards. Also, an average salary having registered nurses, status from the $89,000 per year, shows a number of financial balances which may be persuasive in order to loan providers.