However, currency specialist Dominic Beattie warns some individuals may have to spend loan providers home loan insurance coverage (LMI) to possess another amount of time in buy so you’re able to refinance in case your guarantee inside their home is lower than 20 per cent.

“The cost of LMI by yourself – have a tendency to thousands of dollars – may override people short-title offers you are looking to generate because of the refinancing, very you’ll want to estimate be it worthwhile,” Mr Beattie said.

“In a number of really particular items, you’ll be able to be eligible for a partial reimburse of one’s earliest LMI premium your paid, but never depend on this.”

New RBA keeps leftover interest rates for the keep, but much more hikes are essential once the 550,000 more people be removed repaired mortgages.

“This is someone with a mortgage which they eligible for inside going back, however, wouldn’t around newest things, so they find themselves in zero standing in order to often discuss with its latest lender or change to a different sort of bank because they are today reported to be a dangerous debtor,” the guy told you.

Generally speaking, loan providers have a tendency to determine consumers on their power to shell out finance from the this new stated interest additionally the serviceability boundary out of 3 for every single penny, relative to APRA guidelines, to allow for potential interest rises.

“Having mortgage prices today as much as 6 per cent p.a. or more, consumers are now actually examined to their ability to repay that loan that have a good 9 per cent p.an excellent. interest, this is why their credit fuel is gloomier, placing all of them prone to are home financing prisoner,” Mr Beattie said.

But Mr Sutton claims not all try forgotten just like the some loan providers has actually paid off serviceability examination to a single per cent getting consumers just who no credit check loans in Copper Mountain, CO fulfill certain conditions.

When you do end trapped in the an effective ‘mortgage prison’, label your lender, complete for the maintenance cluster, and you may discuss an educated bargain you’ll be able to.

And if you’re in a position to re-finance with a new bank, do not forget to look at the loan’s analysis rate, just new reported rate.

“A comparison rates will provide you with the true indication of the purchase price off that loan because it requires into account a lot more fees and you may costs,” Mr Sutton said.

Get hold of your lender’s monetaray hardship team

“You should never put your direct on the mud, correspond with the bank very early,” Mr Sutton warns anybody concerned with their facts.

“A difficulty group is there to help you because better they are able to place you in times where you can perhaps catch-up into mortgage payments subsequently.”

Was going for a torn mortgage advisable inside the the current business?

When you’re a torn mortgage is actually a good idea when rates was in fact suprisingly low 24 months before, Mr Sutton contends today might not be the best time for you to think about this alternative.

“The difficulty with fixing currently is all the new economists try anticipating one rates will most likely reduced amount of the second twelve in order to 1 . 5 years,” according to him.

“Until it’s strictly an economic choice and you also wanted the confidence off repayments for the domestic finances, then there’s probably not far merit into the repairing it.

“In a situation in which variable cost are likely to reduced amount of the fresh small in order to medium coming, you’ll also have the great things about lower money.”

A torn financial occurs when you divide your loan on independent account, meaning you could nominate an element of the financing getting a predetermined rate of interest in addition to almost every other with a variable rate.

What takes place if you can’t spend the money for large home loan repayments?

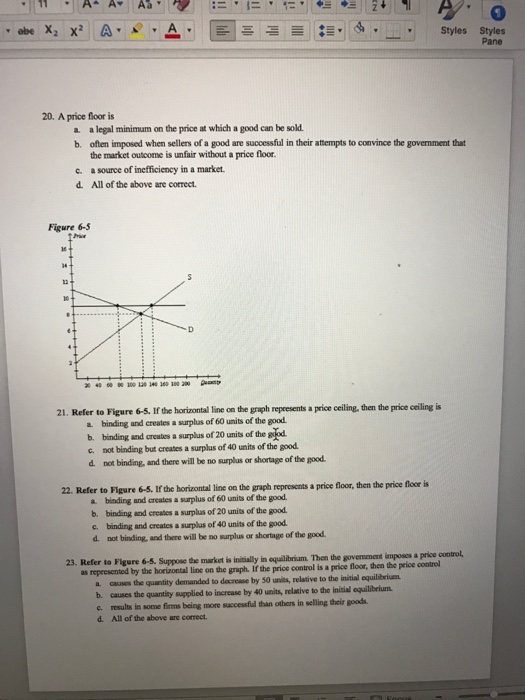

When you do the computations and you can imagine you simply will not find a way to cover the the higher repayments, Mr Sutton says to exercise very early while you can still handle the procedure.