When you make an application for home financing, your own lender commonly evaluate what you can do to help you service the borrowed funds – web browser. do you really be able to pay the loan straight back? Part of which assessment should be to check out most other money or expenses you may have a great, including credit cards otherwise personal loans. Some tips about what you need to know on the personal credit card debt and you may your mortgage software.

Why does personal credit card debt apply to the application?

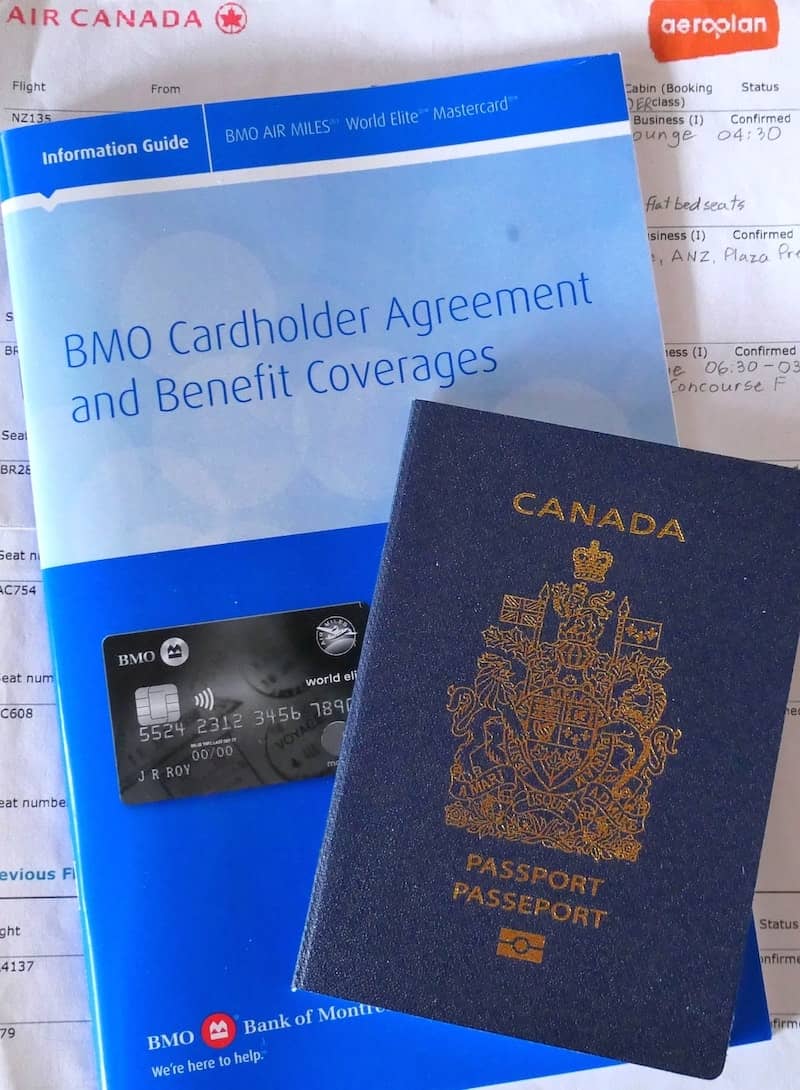

With credit cards isn’t an adverse point. It does put on display your bank you know how to deal with financial obligation and pay a loan. But you should be aware of just how with and using an effective charge card could affect your odds of home loan recognition in the near future.

If your bank was assessing your residence loan application, they’re going to consider your financial situation. One such topic they must dictate is how much you normally use otherwise the borrowing from the bank fuel.

- Searched

- Checked

- Checked

- Checked

- Checked

- Checked

- Checked

When you have a good costs including playing cards, this can impact your own borrowing fuel. That is because your bank would like to have the ability to come across you could potentially do a home loan on top of such economic duties.

Regarding credit cards, lenders takes into consideration all credit card restriction instead than just your own a good credit card balance when choosing exactly how much you normally borrow. This means if you’ve merely invested $step one,000 on your mastercard, however your credit limit is actually $20,000 – your borrowing power can be faster from the $20,000 restriction.

For the reason that your financial needs to account for the point that you might purchase as much as it limitation. They have to make sure to can afford to services your mortgage even in the event your own charge card was maxed aside.

Your own bank card use can also impact your credit score. A credit score assesses whether or not the borrower are able to afford a loan, and it may and dictate their attention rate, as well as their credit limit. Their bank will at the credit rating when determining if or not in order to provide for you. It means whenever you are consistently misusing otherwise mismanaging your own borrowing from the bank credit – this is exactly mirrored on the credit score.

On the bright side, if you have a charge card that have a reduced limitation, and you usually build your repayments, this will be reflected from inside the good credit. An equivalent pertains to that have multiple handmade cards. When you yourself have continuously produced your repayments, your credit score should not be influenced. Although not, it’s important to keep in mind that very lenders prefer to select a thinner credit card background, in place of a long one to.

What is a good credit score?

A credit score try a variety one to selections out-of 0 to help you 1000. Generally, the better brand new rating you earn, the easier and simpler its on how to qualify for financing and it may produce a much better interest rate.

0- 509 (Substandard)

If you get so it score, it means that you will be inside a negative condition (such as, at the mercy of bankruptcy otherwise courtroom judgment). Its more likely one to an adverse event will be registered in the next 12 months.

510-621 (Average)

Your get is within the base 21-40% of one’s borrowing active inhabitants. This indicates one to adverse incidents may to occur to you personally in the next 1 year.

622-725 (Good)

This score ways it is not as likely a detrimental event will come that’ll connect with your credit report within the next 1 year.

726-832 (Pretty good)

Your odds of staying a clean credit report are two minutes much better than the credit-effective society. Negative events try impractical that occurs next one year.

833-1200 (Excellent)

You’re in the big 20% of borrowing-energetic people. It is very unrealistic that a detrimental knowledge manage occur which can harm your credit history next 1 year.

Exactly what are certain tips to manage your credit rating with an excellent glance at to help you trying to get a home loan?

Lenders decide if they will provide money for you according to your credit score. Understanding your credit rating and loans La Salle keeping a good reputation on the credit history increases the possibility of bringing people funds like due to the fact home loans, car and truck loans and you may investment funds.

If you are for the credit card debt, your very best move to make will be to repay so it obligations as soon as possible.

If you your self towards the the right position where you enjoys several funds to pay off from the higher rates of interest, Veda strongly recommend s that you can simplify anything from the merging their personal debt into one loan. Doing this could help cut the level of desire you have to pay while also reducing the level of administrator go out must keep track of brand new money.

If the integration isn’t really a choice, you need another type of means. Normally a smart idea to deal with the mortgage for the highest interest very first, even in the event this will depend towards the sized your debt, later commission penalties or other circumstances certain for the situations.

Ideas on how to improve your credit score?

Your credit rating can transform through the years according to the advice present in your credit score. It is very important that you take control of your finances better. There are certain things you certainly can do to ensure the rating stays highest.

- Pay your home loan or other funds timely

- Pay delinquent credit debt or fund

Any alternative sort of financial obligation make a difference to your residence loan application?

You can contact the team during the to inquire about the qualification for a loan. All of us off lending gurus try here to simply help towards pre-approval process.