Article Guidelines

It takes more 40 weeks to close to the good home, according to individuals items, as well as your full financial situation and you can whether you’re using with cash or financing with a home loan. Though the closing processes are fascinating – it indicates you’re getting nearer to homeownership – it can be challenging. Having a very clear understanding of brand new schedule helps you lose stress to make it with the closure dining table with certainty.

Family closing timeline

The time it entails to close off for the a property utilizes your commission strategy (dollars or financial) and you may mortgage type. Paying having dollars usually expedites the newest closing techniques because it eliminates the necessity for mortgage approval and you can relevant papers.

The new desk below stops working an average closing timelines for different mortgage types – antique funds, FHA funds and you will Va loans.

As you care able to see, this new timelines are comparable along side about three loan items. In order to speed up the fresh new closure procedure, care for discover communication with your realtor, financial or other activities involved in the transaction. It is essential to react on time to requests more info to help you get rid of closure waits.

The fresh new closing procedure: What to anticipate

Closing for the a property does take time since there are several important measures inside, that may for every single simply take from 1 day to numerous months.

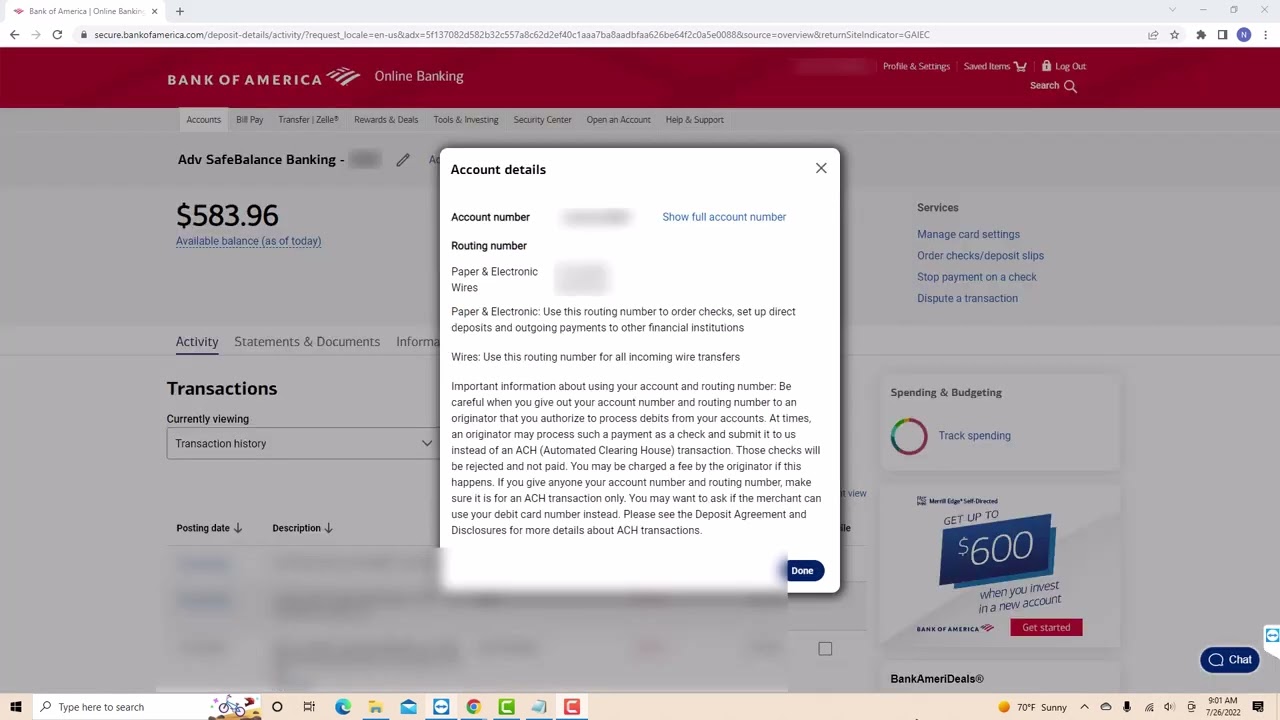

- Mortgage application: One of the primary stages in this new closure techniques should be to fill in home financing software while you are taking right out a great loan. You’ll want to promote your own Social Defense count, address, work suggestions and you can details about the house you want to get.

- Purchase contract: A purchase contract contours the conditions and terms of a real house contract which is typically finalized given that visitors and you may merchant agree on a purchase price.

- Closing disclosure: Lenders should provide an ending revelation, that contains a review of the loan terms and conditions and you may settlement costs, around three business days before your closing go out. It is preferable examine all the details in your revelation along with your loan estimate and have concerns if you notice discrepancies.

- Family assessment: A check is crucial to simply help choose difficulties with the house or property. In case the assessment shows something very wrong towards the domestic, you could negotiate repairs towards supplier.

- Home appraisal: An appraisal decides the residence’s really worth predicated on its area, square footage and total updates. Loan providers generally speaking need a house appraisal to make certain they will not lend extra cash than the residence is really worth.

- Underwriting: Whether to find a property or refinancing, you’ll want to go through an underwriting way to show your qualifications for a financial loan. The brand new timeline to own underwriting depends on the new lender’s processes and also the difficulty of the financial predicament.

- Term search: A bona-fide property attorney generally speaking conducts a title lookup for the closure way to confirm there aren’t any liens, delinquent property taxation or court problems associated with the home.

- Recognition to close: After you found acceptance to close – you may be almost on finishing line. You will need to manage a last go-owing to just before closing to ensure things are affirmed hence the seller complete people needed fixes.

What will happen into closure big date?

Closing go out concerns plenty of documents and signatures. It is important to very carefully review the files and have questions you have prior to signing. Closure documents range from:

> Closing revelation > Mortgage or action out-of faith > Escrow declaration > Mortgage notice > Action > Bikers > Label insurance > Directly to cancel (in the event the refinancing)

Closing costs is expenditures that really must be reduced to accomplish a beneficial payday loans Tuscumbia a property deal. You’ll be able to typically need to pay settlement costs for the title team otherwise closing representative with an authorized glance at otherwise cable transfer – individual inspections are usually maybe not recognized. Settlement costs start from:

> Downpayment > Financing origination and you can application costs > Credit history fees > Prepaid taxes > Mortgage items > Assessment charge > Title insurance coverage > Home insurance > Household review > Real estate professional income > A home lawyer fees

After you have closed the fresh new closing files and you may paid down the fresh closing costs, it is possible to constantly located their tactics the same day. Well done – you will be theoretically a resident!