What exactly are The present Household Interest levels from inside the Huge Rapids?

Less than try a mortgage rates graph* having rates style for the Grand Rapids, Michigan. The latest prices here are getting instructional objectives simply. Displayed data suggest manner and are usually perhaps not prices given by Treadstone Investment to virtually any brand of debtor, while the interest levels are affected by circumstances in addition to borrowing from the bank, loan amount, and a lot more.

*Demonstrated rates represent community styles, plus don’t portray costs offered by Treadstone Financing or Community Money. To possess a precise, up-to-big date estimate into home loan pricing, delight talk to an authorized Mortgage Manager.

What is a home loan Interest rate?

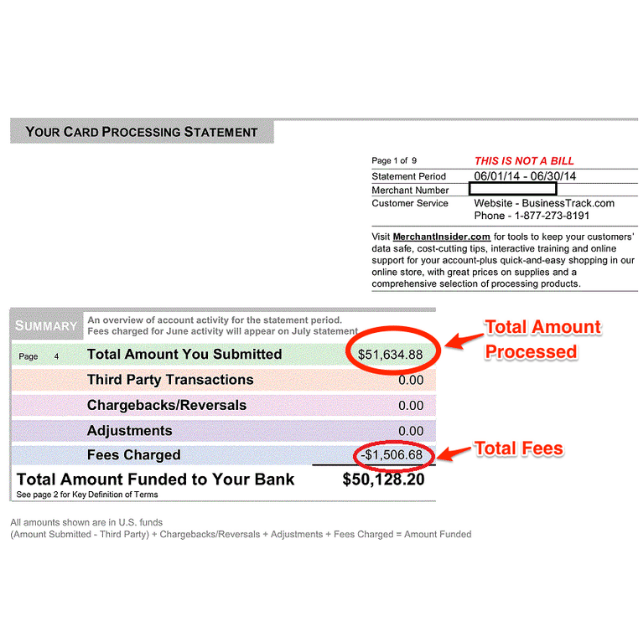

A mortgage rate of interest is a percentage of total loan harmony. Its reduced monthly, with your prominent payment, until your loan was paid down. Its a feature during the determining the fresh yearly costs so you can borrow funds from a lender buying a home or any other property. Instance, If the interest rate is 5%, you’ll owe the lending company 5% of one’s financing balance on a yearly basis through to the mortgage is actually paid back off.

Which price is dependent on several activities throughout the economy and money passion, and additionally private certificates. The newest center grounds? Fannie mae and you may Freddie Mac bundle mortgages, after that offer these to people. Almost any interest rate people people are prepared to pay money for financial-recognized ties establishes exactly what costs lenders can set on their money.

What’s the Difference in Rates and you may Annual percentage rate?

While looking for a house, it’s also possible to discover one or two independent figures indicated as a share: the loan interest rate and also the Annual percentage rate.

Apr is short for apr. An apr (APR) is a wider measure of the expense of borrowing currency than the interest rate. The fresh Annual percentage rate shows the speed, one points, mortgage broker fees, or other costs you pay to find the mortgage. As a result of this, your own Apr is normally greater than their interest rate.

How come the pace Affect My personal Home loan inside Western Michigan?

For the a 30-year fixed-rates financial having an amount borrowed regarding $160,000 during the Michigan, good 0.1% improvement in rate affects your payment by on $10-20, centered on Money Less than 31.

Think about, go out your life- maybe not the marketplace. Would love to purchase to have a diminished interest rate could cost you so much more, specifically since the interest rates was trending upward. Rate of interest shouldn’t be the newest choosing grounds on your own Michigan home buy. Talk to that loan Officer and also make a casino game arrange for your home get, it does not matter the interest rate!

How do i Score a lesser Interest?

Regardless of if mortgage interest levels are determined by the industry fashion, you can find things to do to reduce your notice price.

- Reduce the loan term

- Lay a much bigger downpayment

- Change your credit fitness

- Get disregard circumstances on the mortgage

Faq’s regarding Interest rates

Just what are your rates? Identical to gas pricing, interest rates change each day that is based on your unique situation. Please get in touch with a Authorized Financing Officers to get a price.

How come borrowing affect our rates of interest? Of numerous activities come into play when determining your interest, along with your credit score being singular element of this formula. As a whole, a high credit rating contributes to less interest rate.

What is the difference between my Rate of interest and Apr? Mortgage loan are a share of prominent equilibrium on the your loan billed on an annual base. Attract is repaid month-to-month and amortized over the identity of your loan. Apr (annual percentage rate) products throughout the costs and you can costs of one’s mortgage and conveys all of https://cashadvancecompass.com/loans/students-loans-for-bad-credit/ them just like the a share. It is as expected the Annual percentage rate is higher than the speed.

Exactly what applications are there having very first-date home buyers? Traditional home loan people Federal national mortgage association and Freddie Mac provide earliest-date domestic consumer loan software, called Homeready and you can HomePossible, respectively. You will find income limits and you will borrowing requirements that must be fulfilled to be considered. This type of apps bring a whole lot more positive rates, down personal home loan insurance rates, and you can freedom toward number you could put down.

*Financial rates, data, and you can instances is to own informative objectives merely. No dedication to lend implied. Talk with a loan Administrator to choose the qualification.