The reports are concise and serve the needs of external users who need a clear and summarized view of the financial state. An important aspect of managerial accounting also involves integrating different financial data sources into cohesive reports that are easy for managers to understand and act upon. For instance, cash flow analysis can help monitor the company’s liquidity to ensure there is enough cash on hand.

Do Managerial Accountants Need to Follow GAAP?

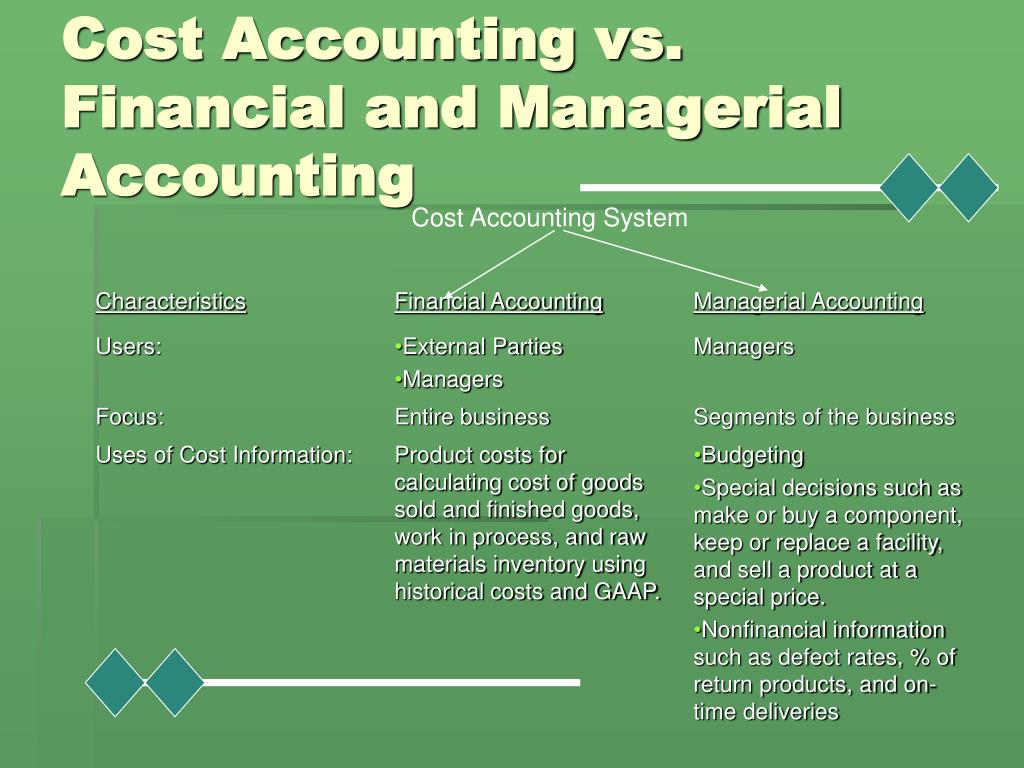

With IFRS becoming more widespread on the international scene, consistency in financial reporting has become more prevalent between global organizations. Financial accounting (or financial accountancy) is the field of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. Managerial accounting aims to improve the quality of information delivered to management about business operation metrics. Managerial accountants use information relating to the cost and sales revenue of goods and services generated by the company. Cost accounting is a large subset of managerial accounting that specifically focuses on capturing a company’s total costs of production by assessing the variable costs of each step of production, as well as fixed costs. Technologies like cloud computing can play an important role here by providing real-time data access and sharing so that the finance department can quickly respond to changes and provide timely updates to the management.

Functions of Financial Accounting

This is the phase of accounting concerned with providing information to managers for use in planning and controlling operations and in decision making. Managerial accounting also involves reviewing the trendline for certain expenses and investigating unusual variances or deviations. It is important to review this information regularly because expenses that vary considerably from what is typically expected are commonly questioned during external financial audits.

- Whether it is financial accounting or managerial accounting – a business needs both to survive and grow.

- Managerial accountants help determine where bottlenecks occur and calculate the impact of these constraints on revenue, profit, and cash flow.

- Calculating inventory turnover can help businesses make better decisions on pricing, manufacturing, marketing, and purchasing new inventory.

- So, effectively managing costs and their impact on the company’s profitability is key to ruling the market.

- In managerial accounting, the quantity and dollar value of the sales of each product are likely more useful.

Managerial vs Financial Accounting

Performance analysis helps you understand the reasons behind good and bad performance and use these insights to make improvements. Let’s say a business witnesses increasing production costs; managerial accounting might reveal how a specific process is less efficient than expected. This can be followed by a review and optimization of that particular process to perform better.

All of this readily available information can lead to great improvements for any business. No external, independent auditors are needed, and it is not necessary to wait until the year-end. Managers should understand that in order to obtain information quickly, they must accept less precision in the reporting.

Adhering to Compliance Requirements

And those wanting to pursue managerial accounting should get a CMA (certified management accountant) credential. Financial accounting reports are typically generalized and concise, and information is less revealing because they are available to outside parties. Financial accounting focuses on statements based on financial information, to be shared with both internal and external shareholders. These financial statements are due at the end of an accounting period, typically once a year, although they may be compiled more frequently. On the other hand, International Financial Reporting Standards (IFRS) is a set of passionable accounting standards stating how particular types of transactions and other events should be reported in financial statements.

Managerial accountants often monitor company investments in conjunction with other managers. They may also participate in risk management, tax planning, preparation of financial statements and supervision of bookkeepers and other office staff. In financial accounting, what forms a good business team accountants are responsible for preparing financial statements, such as the income statement, balance sheet, and statement of cash flows. Both financial accounting and managerial accounting deal with financial information, however, with a different approach.

But recently information relating to cash flows and earning per share is also provided, with the help of a financial statement. So, even when a company uses GAAP, you still need to scrutinize its financial statements. Accountants are directed to first consult sources at the top of the hierarchy and then proceed to lower levels only if there is no relevant pronouncement at a higher level. The FASB’s Statement of Financial Accounting Standards No. 162 provides a detailed explanation of the hierarchy. Because managerial accounting is not for external users, it can be modified to meet the needs of its intended users.

This equation must always balance as it reflects that all assets are financed either through debt (liabilities) or shareholders’ equity. Understanding and analyzing financial ratios is equally critical here, mainly the current ratio (current assets divided by current liabilities), which measures liquidity. A higher debt-to-equity ratio, on the other hand, reflects that a company is more dependent on borrowing to finance its growth and operations. If you prefer a multifaceted role in a fast-paced environment (e.g., working in a startup finance team) managerial accounting is a suitable path.

And while the specifics of tax accounting are clear, the line is blurry when it comes to the other two branches. This article sheds light on the matter by examining the managerial accounting vs financial accounting juxtaposition. Managerial accounting information is more future-oriented because it is used to make decisions about the future of the organization. Financial accounting information, on the other hand, is focused on reporting past performance.